What is commercial proporty

Commercial property refers to real estate used primarily for business purposes, generating income through capital gains or rental income. It can include office spaces, retail properties, industrial properties, hospitality properties, mixed-use properties, and special purpose properties. Key features of commercial properties include their purpose, higher investment returns, compliance with local zoning regulations, and long-term leases.

Uses of commercial property include setting up businesses, renting out to tenants for income generation, and investing for capital appreciation over time. Factors to consider when buying commercial property include proximity to customers, suppliers, and public transportation, zoning and permits compliance, demand and growth analysis, infrastructure considerations like parking, accessibility, and utilities, rental yield and ROI evaluation, legal due diligence, and market trends. Best commercial property’s in Hyderabad

Choosing wisely based on these factors can make best commercial property a lucrative investment or business asset. Factors to consider include proximity to customers, suppliers, and public transportation, zoning and permits compliance, demand and growth analysis, infrastructure considerations, rental yield and ROI evaluation, legal due diligence, and market trends. By carefully selecting commercial property, businesses can capitalize on its potential for growth and profitability.

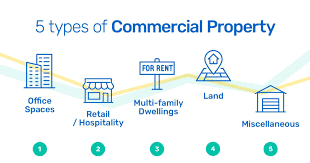

Types of Commercial Property:

-

Office Spaces:

- Buildings or spaces used for administrative and business operations.

- Examples: Corporate offices, co-working spaces, IT parks.

-

Retail Properties:

- Properties designed for selling goods and services to consumers.

- Examples: Shopping malls, retail stores, showrooms, and standalone shops.

-

Industrial Properties:

- Real estate used for manufacturing, production, storage, or distribution.

- Examples: Warehouses, factories, industrial parks.

-

Hospitality Properties:

- Real estate used for tourism and accommodation.

- Examples: Hotels, resorts, serviced apartments.

-

Mixed-Use Properties:

- Properties that combine commercial, residential, and sometimes industrial uses in the same building or complex.

- Examples: Buildings with ground-floor retail shops and residential apartments above.

-

Special Purpose Properties:

- Unique properties that don’t fall into the above categories but serve specific business needs.

- Examples: Schools, hospitals, theaters, gyms.

The following documents are essential for verifying the ownership and transfer of property in a property transaction:

- Title Deed (Sale Deed or Conveyance Deed): Confirms the ownership and seller’s right to transfer the property.

- Parent Document/Chain of Ownership: Traces the history of ownership to confirm legal transfer over time.

- Encumbrance Certificate (EC): Ensures the property is free from legal liabilities or unpaid dues.

- Approved Building Plan and Layout: Confirms that the building or property complies with legal construction and layout regulations.

- Occupancy Certificate (OC): Certifies that the building is ready for commercial use and complies with local building laws.

- Property Tax Receipts: Ensures no pending property taxes against the property.

- No Objection Certificates (NOCs): Confirms clearance from various departments for commercial use.

- RERA Registration Certificate: Ensures property complies with the Real Estate (Regulation and Development) Act, 2016.

- Khata Certificate and Extract: Confirms property registration in local municipal records.

- Land Use Conversion Certificate: Shows conversion to commercial use for properties developed on agricultural land.

- Sale Agreement: Contains terms and conditions of sale, including price, possession date, and other clauses.

- Lease Agreement (If Applicable): Defines tenancy Commercial property investment terms for properties being leased.

- Mutation Certificate: Updates property ownership details in revenue records.

- Power of Attorney (If Applicable): Verifies the validity of the document if the property is being sold by someone holding power of attorney.

- Development Agreement (For Joint Ventures): Outlines roles of all parties.

- Utility Bills: Ensures no pending dues on utilities like electricity, water, and gas.

- Bank Loan Documents: Confirms existing loans or mortgages.

- Soil Test and Structural Stability Report (For Large Properties): Ensures land and building are suitable for commercial purposes.

- Court Clearance Certificate: Confirms no ongoing disputes or litigation regarding the property.

- Builder-Buyer Agreement (For Under-Construction Properties): Details terms and conditions agreed upon with the builder.

What is residential properties

Residential property is real estate designed for individuals or families to live in, such as apartments, houses, villas, and plots within residential zones. To buy residential property in Telangana, follow these steps:

- Determine your requirements and budget, including type, location, and additional costs like registration, taxes, maintenance, and legal fees.

- Shortlist popular residential areas in Telangana, such as Best residential plots in Hyderabad, Gachibowli, Kondapur, Miyapur, and Manikonda. Compare prices and property appreciation Residential potential.areas in hyderabad

- Verify the property’s ownership, approvals, and RERA registration. Key documents include Sale Deed/Title Deed, Encumbrance Certificate (EC), Occupancy Certificate (OC), Approved Building Plan, Property Tax Receipts, Khata Certificate, Land Conversion Certificate, Layout Approval, Survey and Boundaries, and Mutation Records.

- Hire a property lawyer for legal verification, verifying the seller’s legal status and ensuring no outstanding loans or legal disputes.

- Negotiate the price and finalize terms, signing a Sale Agreement, and applying for financing.

- Pay stamp duty and registration charges, register the property at the Sub-Registrar’s Office, and obtain the Registered Sale Deed.

- Post-registration formalities include mutating property records, transferring utilities, and registering property tax.

To ensure a smooth process, work with a reliable real estate agent or broker, check if the project is RERA-approved for under-construction properties, and visit the property in person.